|

Tinkering with the regulation of banks is like shuffling deck chairs on the titanic. The entire system is a fraud, writes Eamonn Dwyer.

Let me tell you a confidence trick. Let me tell you a confidence trick.

Our hustler is called Lenny. He has a suit tailored for himself on Savile Row, hires plush, marble offices in the centre of the city, and waits for suckers to walk in the revolving door.

His first mark is Average Joe. He has £1,000 saved under his bed and is deciding what to do with it. Who better to ask than the man who already looks wealthy? Lenny offers him a deal; he’ll keep Joe’s money in his safe. In fact, he’ll actually give him a little extra every year for the privilege of keeping it. Instead of his cash gathering bed bugs under the mattress, Joe can be making money by doing nothing whatsoever.

Joe likes the sound of that, and gives Lenny his money. As he’s walking out the revolving doors, another sucker called Gerald comes in. He’s got a different problem for Joe; he’d like to buy a car for £9,000, but doesn’t have the cash.

“No problem”, says Lenny, “I can lend you some”. He writes a cheque for £9,000 (ten times the amount Joe left with him, minus his deposit). Gerald goes out the door and buys the car he wants. The car seller turns out to be Joe, who returns with the cheque. He wants to cash it, but the hustler convinces him he should just deposit it in his new account. Joe checks out his balance; a cool £10,000.

Now, here’s the genius of the con. Out a mere deposit of £1000, the hustler now has a balance sheet of £10,000 deposits and £9000 loaned. If Gerald fails to meet the payments on his car, the hustler gets to own it. And if Joe ever wants to see proof of his money, all the hustler needs to do is show him a statement of his account. In truth, Lenny only has £1000 in his safe.

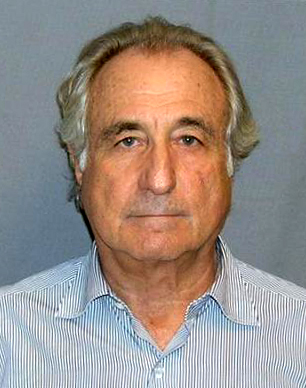

(Bernie Madoff’s victims were convinced they were making huge sums of interest on their deposits. But he never had to show them the cold hard currency - a monthly investor statement was all it took.) (Bernie Madoff’s victims were convinced they were making huge sums of interest on their deposits. But he never had to show them the cold hard currency - a monthly investor statement was all it took.)

One day Joe comes in and wants to take his money out. He’s decided it to move it to Peter’s safe, down the road. No problem, says Lenny, and writes him a cheque.

You see, what Joe doesn’t realise is that Peter is also a hustler. He too has been lending out money he doesn’t have, and some of Peter’s customers have written cheques to Lenny. But instead of going around to each others’ offices to collect the cash every time they receive a cheque, they only settle the balance.

Now, because the business between Lenny and Peter is fairly even, the balance is typically a small amount – so they only need to hand over the cash for a fraction of what they have on their books. As long as most of their customers don’t withdraw their entire balance in cash, it’s not a problem.

What I’ve just described is the world’s greatest con trick. It’s called ‘fractional-reserve banking’, and not only is it completely legal, it’s at the centre of the West’s debt based economy. Banks can lend out a massive multiple of what they have on deposits. A run on the banks isn’t disastrous because they have lent out our money; it’s disastrous because in many cases they never had it in the first place.

To some extend, we intuitively know banking is a fraud. When you lend a bank your money, the ostensible premise is they are in turn lending it to someone who they will charge interest to. But if they have lent your money out, it’s not really in the bank. Their deposit slips are collectively false.

Fractional-reserve banking takes it a step further and lends out money that was never deposited in the first place. As long as the person you give the ‘bank money’ to accepts it instead of demanding hard cash, everyone’s happy.

In fact, economists have a special designation for bank money; ‘M3’. That's two steps removed from ‘M0’, otherwise known as cash. Yet even in a post-banking crisis world, we still regard ‘bank money’ as being the real thing.

The scheme works as long as there is continual economic growth. In a static economy, there is a fixed supply of money. There are no net innovations or discoveries to expand the economy. Banks offering interest in such an environment would be seen as obvious fraudsters because it’s a zero sum game.

The lockstep interest rates of banking currently can only supported by continual economic growth. If banks did offer interest rates in a static economy, it would simply create inflation. You don’t need to be Milton Friedman to understand that someone printing money lowers its value.

In this way, fractional-reserve banking is mainly responsible for inflation, a relatively recent invention that robs the wealth of the many. For hundreds of years in Britain, the price of a load of bread was practically the same. It is only in the last two hundred years, and particularly this century, that the curse of inflation has become endemic in the Western world. It doesn’t have to be this way; Japan, one of the world’s quiet superpowers, has consistently had virtually zero inflation for the past fifteen years.

We often think of Central Banks like the Bank of England, as being the creators of ‘new money’. They print the notes and forge the coins, after all.

In truth, Central Banks have been created to secure the deposits of private banks. ‘New money’ is not created by governments; it is created by private banks making loans with money they don’t have. As John Maynard Keynes noted, the ease by which banks create new money is obscene.

Take the recent ‘quantitative easing’ measures carried out by the Bank of England. It was often described as ‘printing money’, which it is. But the bizarre transaction involved the government selling bonds to private banks, who in turn lent the government money. What this reveals is that it is private banks, not the government, who are in control of the money supply.

Practically everyone agrees the bailouts were appalling; an outrageous mass transfer of public funds to private coffers. Yet world leaders seem completely powerless. Bankers have a gun to their head - mess with us, and we'll blow you're brains out. (That's paraphrasing; what they're actually saying is 'Regulate us too much Moody’s will lower your credit rating.'). Practically everyone agrees the bailouts were appalling; an outrageous mass transfer of public funds to private coffers. Yet world leaders seem completely powerless. Bankers have a gun to their head - mess with us, and we'll blow you're brains out. (That's paraphrasing; what they're actually saying is 'Regulate us too much Moody’s will lower your credit rating.').

Indeed, most Western governments are committed to reducing the national deficit at the banks’ behest. If they don’t, they will have their credit rating reduced, which will increase the cost of lending. Like an abused domestic wife, Britain is under the thumb of the man controlling the purse strings.

Banks are bloodsucking parasites, akin to casino operators, or bookies. The difference is, when you go up against the house, you've got a chance of winning. With banks, they win every time. Fail to realise the interest to pay off your loan, and they claim the assets you've staked against it. Pay back the interest, and they've made money. And if too many people start asking for their cash, governments will do whatever it takes to prevent these fraudsters from collapsing.

Interest-rate based banking is the greatest Ponzi scheme ever invented. It doesn’t last decades; it lasts centuries. So long as there is continual economic growth, banks can keep offering capital and interest investment. We’re hooked on growth because the banks are hooked on growth.

But that’s the problem. Growth cannot go on forever. We are in the twilight of the fossil fuel age which has driven the unprecedented expansion of the past one hundred and fifty years. With the end of oil, comes the end of banking, and with it, the end of debt-based currencies. The financial crisis we’ve just been through is a minor prelude to what’s going to come.

eamonn.dwyer83@gmail.com

http://www.twitter.com/eamonndwyer

|